How to invest for your goals – not for headlines

We have long been advocates of diversification and deploying a portfolio beyond the stocks of large U.S. companies and U.S. Treasury bonds. It seemed like a good idea two decades ago when our firm was founded. Since then we have seen bubbles in tech stocks and real estate, two rough bear markets in which the Dow dropped about 50%, the Great Recession and numerous other economic “crises,” the 9/11 attack, the ensuing war on terrorism, multiple tax code changes, various mixes of Republicans and Democrats in the White House and controlling the houses of Congress, and thousands of predictions about what the economy and markets will do next.

Despite all these items, some of which were newsworthy and some just noise, our commitment to broad diversification is even stronger. Diversification is a friend to true investors.

Why Diversify?

For now, we’ll restrict our discussion to stocks but the same principles will also apply to bonds. We will look at three of the many reasons to diversify beyond just large U.S. companies such as those that make up the Dow Jones Industrial Average or S&P 500 index.

- Small companies and “value” companies are expected to produce higher returns than large or “growth” companies over long time periods. A slew of research conducted over the last 40 years has shown this to be both true and universal. In fact, one of these researchers, Eugene Fama, won the 2013 Nobel Prize in Economics in part for his work on this issue.

- Though the U.S. still possesses the largest financial market in the world, most of the world’s markets reside out of the U.S. Many U.S. firms derive a significant amount of their worth from their overseas endeavors. Offshore investments should not be ignored.

- Since all of the stock asset classes we favor are expected to provide a return greater than inflation, although not necessarily moving in lock step with each other, combining them can produce a steadier return. It is correct to say “steadier” not “steady.” Stocks should never be expected to be steady. We have to tolerate the ups and downs of the stock market in order to improve our odds of staying ahead of inflation.

If after-inflation returns can be achieved from a steadier path, the odds of reaching financial objectives are greater. Naturally, steadier returns are preferred. Mathematical analysis also indicates steadier is better. In the table below, both portfolios average 8% but because Portfolio B is steadier than Portfolio A, the rate at which the returns compound is higher. Over time, this adds up to a considerable difference to the bottom line.

Steadier is Better

|

|

Portfolio A | Portfolio B |

|

Year 1 |

-10% |

-1% |

|

Year 2 |

7% |

8% |

|

Year 3 |

27% |

17% |

|

Simple Average |

8% |

8% |

|

Compound Average |

6.941% |

7.749% |

|

In 20 years, $1,000 compounds to… |

$3,827 |

$4,450 |

If after-inflation returns can be achieved from a steadier path, the odds of reaching financial objectives are greater.

The Less Diversified Path

The alternative to being broadly diversified is more overall risk or lower returns.

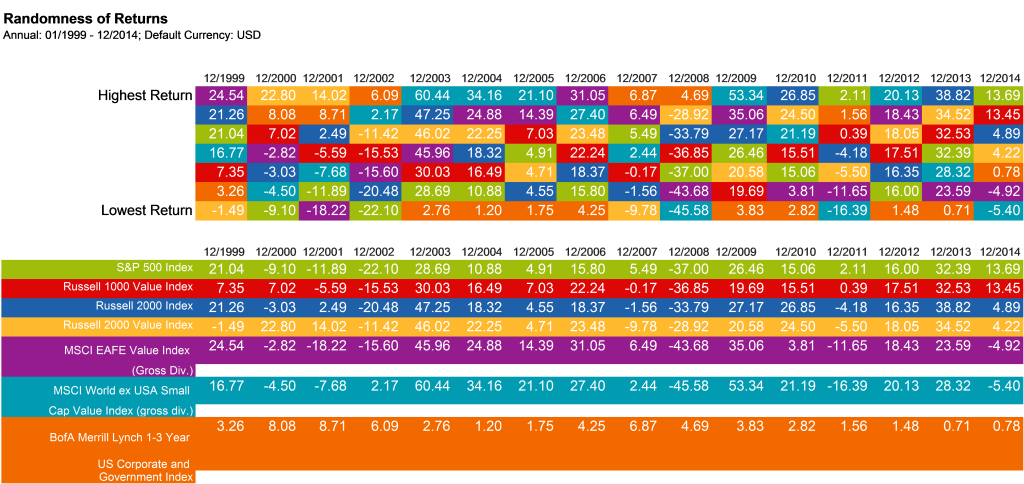

Consider the result that would have been experienced if one did not own any value or small company stocks (we’ll call them premium classes) and just owned the stock of large U.S. companies, like one would find in the Dow or S&P 500. The table below, “Randomness of Returns” shows the year by year results of a few indexes that are reasonable proxies for selected asset classes. In 14 of the last 16 years, at least one premium class (red, blue, tan, purple and light blue) topped the S&P 500 (green). Shorter term bonds (orange) were best only three times but also did not have a single negative year. In only two of the years was the S&P 500 the top performer. Simply put, this past year is an exception, not the rule. [i]

Note that all of the premium classes added additional returns in at least 10 of the last 16 years, although not in the same years. In fact, there were only six years in which all the premium classes returned more than large U.S. companies. In most years, some premiums will add value and some will detract.

Also notable is the difference between returns of the classes can be substantial. This creates an opportunity (temptation may be a better word) to try to move in and out of asset classes based upon which class you thought would perform best. This is just another form of market timing, an approach filled with pitfalls. In last quarter’s newsletter, we cited a study by Richard Bernstein Advisers (RBA) that tracked the buying and selling of mutual funds over the 20 year period from 12/31/1993 to 12/31/2013 and described the performance of the typical mutual fund investor as “shockingly poor.”

We wrote, “The typical result was worse than what could have been obtained by simply leaving the money in cash. With the ups and downs of markets such as they are, it can be tempting to try to anticipate the market’s next moves. This study is just the latest reminder that this strategy is unlikely to work. An investor who bought and simply held on would have done better in 40 of the 42 asset classes.”

Why is it so hard to move between asset classes profitably? The “leadership,” meaning which asset classes are performing best, is in constant flux. The best performing classes start to look expensive and the worst start to look cheap. The hot performers cool off and the cool heat up. However, the rate of these changes is unpredictable. As you can see from the table, often the top performing classes quickly become the worst performing. But sometimes, their superiority persists. The S&P 500 may be the best performer next year too but it would be unusual for it to top this list for more than a few years.

If you see a pattern or trend, it is a figment of your imagination. Neuroscience tells us that our brains are wired to seek out patterns and trends but a thorough statistical analysis reveals there is no pattern or trend that indicates how well a class will perform. The change in “leadership” is inevitable but not predictable with any precision. To profit, you have to be correct in your speculations by enough to compensate for the costs of taking your positions. Over time, the hard costs (trade fees, taxes etc.) and the cost of being wrong adds up.

In short time frames, results are chaotic. In some periods such as the late 1990’s, large U.S. companies did better than most of the premium classes. In the next few years, large U.S. companies lagged more often than not. Lately, the results of large U.S. companies relative to the premium classes have been varied.

…a well-designed portfolio has tended to produce returns that are competitive or superior to that of just large U.S. companies and the returns tended to come in a less risky manner.

A more reliable approach than trying to move between classes is to start with each client’s unique needs and establish an array of asset classes based on those goals. Then select asset classes with good expected long term returns, maintain holdings in those classes at all times, manage taxation, and rebalance sensibly. By doing this, a well-designed portfolio has tended to produce returns that are competitive or superior to that of just large U.S. companies and the returns tended to come in a less risky manner. The expected behavior for a broadly diversified portfolio on a year to year basis is that it will lag the top performing asset class but better the worst performing asset class.

No one knows what the future holds and there is no guarantee future results will follow suit. Nonetheless, despite the chaotic fluctuations in returns during short time frames, over time a disciplined approach has made a difference. By staying diversified, exercising discipline, and being patient, we believe the odds of getting a superior result improve.

News & Notes

New in your client portal: We implemented on-line client portals in 2014 to provide clients a more secure way to transmit documents and to give them a comprehensive look at their total portfolio, regardless of which financial institutions may hold their accounts. In December, we made available a complete transaction history for all accounts in a client’s household. When in your portal just click on “Transactions” under the “Reports” menu. If you have questions contact Mike Salmon at extension 112 or Derrick Chandler at extension 105.

Our Melbourne office has moved to a new suite: As of January 1st, our Melbourne office has moved to a new suite in the same building. Our office is located in a corner suite facing Wickham Road. The suite is directly under the Moisand Fitzgerald Tamayo sign, overlooking the fountains. The entry door is on the second floor porch on the side of the building. The new suite is still numbered 215 so there is no change in our mailing address.

Please remember to call us: When anything significant happens in your life, including changes in your finances, family, or health that could affect your financial plan, please let us know so that we can adapt our planning and portfolio work for you accordingly. Also, if you ever fail to receive a monthly statement for one of the Schwab Institutional or TD Ameritrade Institutional accounts under our management, please let us know so we may assure the respective custodian delivers your statements promptly.

Yours truly,

The Team at Moisand Fitzgerald Tamayo, LLC

Contact Us

If you have any questions or would like to discuss this further, please give us a call, email us or send us a note.

If you are not a client and you wish to receive emails notifications of new posts – no more than monthly – fill out the subscription information in the sidebar to the right. For more frequent updates, subscribe via RSS feed or follow us on Google+, LinkedIn, or Twitter

[i] Selection of funds, indices and time periods presented chosen by client’s advisor. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results. Russell data copyright © Russell Investment Group 1995-2013, all rights reserved. The S&P data are provided by Standard & Poor’s Index Services Group. MSCI data copyright MSCI 2013, all rights reserved. The BofA Merrill Lynch Indices are used with permission; copyright 2013 Merrill Lynch, Pierce, Fenner & Smith Incorporated; all rights reserved. Merrill Lynch, Pierce, Fenner & Smith Incorporated is a wholly owned subsidiary of Bank of America Corporation.